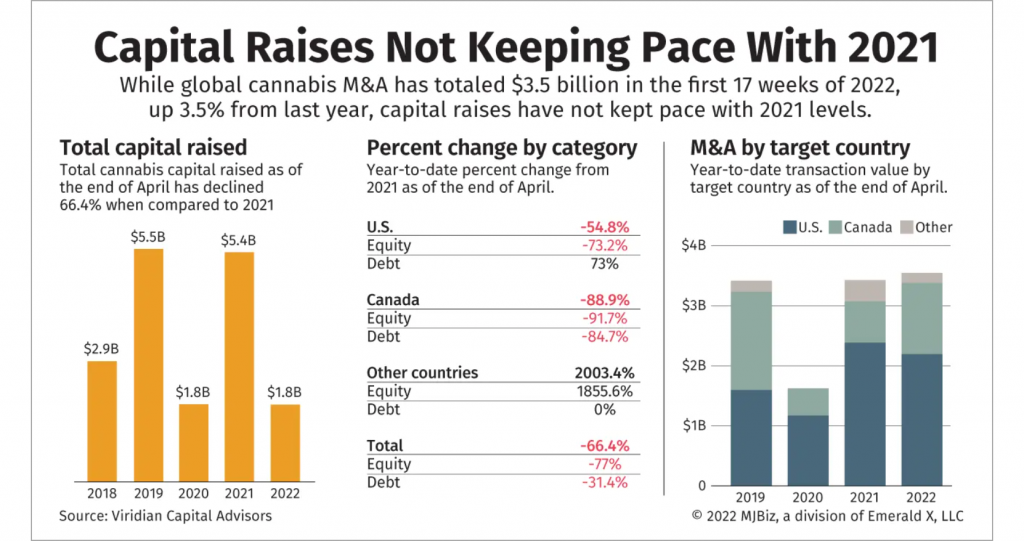

2022 has been a tough year for cannabis companies seeking equity investment. Global equity raises have declined 77% year-to-date, to $962.1 million. I’ve seen even promising, patent-holding cannabis companies struggling to find the right investment partners.

This is likely not going to change until corporate valuations improve, according to some industry execs.

“Cannabis is a defensive industry,” Andrew Fellus, CEO of Canna Business Resources (CBR) told me in an interview. “Investors in general view this industry as defensive because it’s not going anywhere. Even if it does slow down a bit, it’s not going to zero.”

Fellus remarked that industries like electric vehicles have a lot more investment risk than cannabis. His point is well taken, as California based electric vehicle manufacturer Rivian lost $1.7 billion in the second quarter of 2022.

Equity investors know the cannabis industry will always be an investment option, are holding out for a stronger market, and are meanwhile looking for some meaningful short-term fundamental results elsewhere.

Still, cannabis operators need to expand in light of the fact that there is less capital available in the market. Many are left to find consolidation parters that can provide some liquidity or better access to capital. For operators like these, accepting multistate operator stocks at current discounted levels presents a potential upside in a merger or acquisition deal.

Viridian Capital Advisors tracked 75 mergers and acquisitions transactions globally with a total value of $3.5 billion through the end of April 2022, up 3.5% from the same year-to-date period in 2021.

Cannabis Debt Financing on the Rise

By contrast to equity investment, cannabis debt financing is up 73% year-to-date in the U.S., to $729.3 million. This bodes well for the team at CBR that specializes in cannabis debt financing.

CBR provides cannabis companies with growth capital, acquisition financing, equipment financing, CRE financing, or special situation financing. The company can provide funding up to $20M as a bridge to an equity deal or a just general working capital facility, both first and second lien loans, and is often able to structure financing that is complementary to an existing credit facility.

The company is a market leader in providing 2nd lien loans to cannabis operators with additional capital needs beyond what their existing senior lender is willing to provide. A unique product is tailored to companies that have an existing senior lender, can demonstrate sufficient cash flows, and are looking for a creative capital solution.

“We’re not equity players, we don’t invest in the equity, we don’t own the equity, we provide financing options for working capital for businesses that either need to grow or that are just getting off the ground,” Mr. Fellus explained. “And instead of taking eight months in investor discussions and going out of business in the meantime, we can close a financing in as little as one week.”

Financing New York Cannabis Operations

CBR prominently represented itself as a capital source and viable alternative to equity investment at the recent Benzinga Cannabis Capital Conference in Chicago, IL. With timely progress in New York’s Adult Use licensing activity, CBR presented cannabis operators with a faster, non-dilutive financing option to quickly tap into the state’s market opportunity.

CBR knows that cannabis entrepreneurs and existing companies in the licensing process must line up their working capital today to prepare for a surge of demand next spring. The New York market is bound to be supply constrained and that means manufacturers can be a bottleneck, or they can be a resource. Having the right amount of working capital to launch a thriving and critical part of the supply chain.

For soon-to-be New York dispensary owners, shelves need to be fully stocked with enough supply in inventory to make it through an expected surge in demand upon opening. And for cultivators, massive amounts of working capital will be needed to bring much needed high-quality flower to the regulated New York market on a timely basis.

Mr. Fellus, himself a lifelong New Yorker, said that the New York market will require billions in investment in infrastructure, marketing, product development and compliance, and that CBR has set up a separate division and allocation to underwrite and finance New York market participants.

CBR has a track record of success assisting new and growing cannabis businesses with capital resources to seize opportunities brought about by regulation and legal change. When final regulations were approved for consumption lounges in Nevada, CBR was able to help a client acquire a suitable property with which the operator could vertically integrate its existing cultivation operation into a retail store with attached lounge.

The company provided $3.5 million in loans, consisting of a $2.5 million in real estate acquisition and $1.0 million for working capital needs. The working capital needed for the facility included tenant improvements, furniture and fixtures, personnel, and inventory. The loan was structured at a 75% Loan-to-Value ratio with a three year-term and interest only component. The cannabis real estate loan has a three year balloon.

In some cases, CBR even offers exclusive interest only structures.

Understanding Hurdle Rates

A the halfway point of the year, interest rates began to rise, impacting the cost of capital for borrowers. At the same time, it’s also impacted hurdle rates for investors. As Mr. Fellus explained it, “The Hurdle rate being the hurdle you need to overcome in order to be a profitable investor.” So, the hurdle rate being your total cost of capital.

“So the way you would look at it if you’re an investor is, ‘Okay, I’m borrowing money from somewhere, whether it’s investors or otherwise,” Fellus said. “The cost of that capital is ‘X’ plus your cost of overhead investment committee compliance, all of which are going up. So, it’s not getting easier to run one of these lenders or investor groups because the regulatory burden is increasing and so that means your hurdle rate is going up.”

If your hurdle rate going up, then the cost of capital to the borrow is also going up. As an investor, to be

profitable on your investment costs you more. “I think a lot of people don’t know that cannabis is still a nascent industry when it comes to talking about really openly talking about the inner workings of finance,” Fellus continued.

The Future of Cannabis Debt Financing

Many, many successful entrepreneurs are in this industry and they’ve done well for themselves and they

haven’t needed outside financing. But when they do, as Mr. Fellus pointed out, they begin to see how the hurdle rates work for private capital and it’s more expensive than they anticipated.

“As the cannabis industry becomes more competitive, it’ll become prohibitive to bootstrap it and you’ll need outside capital,” Fellus said, “So I think it’ll become more prevalent to the discussion of cost of capital in the industry in the next couple years.”

As a family office with its own money, CBR “We don’t need to get our capital from anywhere else, and we have set rates for borrowers that we’ve been doing for years that are not economically sensitive,” Fellus explained, citing his company’s advantage for its borrower clients. “I call them clients because they really are–like half the time I spend my time helping them learn how to run their business.”

In today’s capital sparse cannabis industry, having a lending partner that will not only provide the resources to operate and grow, but guide your business along the way is an ideal scenario. And for small and medium sized cannabis operators not looking to participate in an M&A, CBR offers an appealing alternative and an opportunity to have a financing partner that will evolve as their business does.