Press ReleaseUnlocking Savings: FOHSE Introduces Energy Rebate Program Offering Up to 70% Rebate on LED Lighting for Cannabis Growers – FOHSE, a pioneering force in horticulture science and engineering for the cannabis market, announces an innovative State-to-State Energy Rebate Program aimed at revolutionizing the way cultivators approach lighting solutions. This initiative is set to transform the landscape of cannabis cultivation by offering unprecedented savings of up to 70% on retrofits from traditional HPS to cutting-edge LED lighting applications for your grow facility.

With the cannabis industry experiencing exponential growth, cultivators face substantial initial startup costs. FOHSE recognizes this challenge and has partnered with states across the nation to introduce and assist with game-changing rebate programs designed to alleviate financial burdens and accelerate the transition to energy-efficient LED lighting solutions.

CEO and Co-Founder of FOHSE, Brett Stevens, expresses profound enthusiasm for the program, stating, “We are thrilled to introduce these rebate programs to our valued clients. At FOHSE, we are committed to driving innovation and sustainability within the cannabis cultivation industry. By leveraging state-of-the-art LED lighting technology and collaborating with forward-thinking states, we are empowering cultivators to optimize their operations while significantly reducing their environmental footprint.”

The State-to-State Energy Rebate Program not only benefits cultivators but also delivers substantial advantages to participating states. By incentivizing the adoption of energy-efficient LED lighting, states can achieve significant reductions in energy consumption, enhance HVAC efficiencies, and promote sustainable practices within the cannabis industry. FOHSE constantly stands tall with some of the highest efficiency ratings in the industry, for their entire line of products.

Stevens emphasizes, “This initiative underscores our dedication to sustainability and environmental stewardship. By embracing LED lighting solutions, cultivators can achieve remarkable energy savings, enhance crop quality, and contribute to a greener future for all.”

FOHSE clients are poised to reap substantial rewards through the rebate program, with some eligible for even greater incentives. The program’s implementation marks a significant milestone in FOHSE’s ongoing mission to drive innovation and foster sustainability within the cannabis cultivation sector.

For more information and qualification details about FOHSE and its State-to-State Energy Rebate Program, please visit www.fohse.com or contact 888-364-7377 to connect with an LED lighting expert.

About FOHSE:

FOHSE, the Future of Horticultural Science & Engineering, a leading manufacturer of high-performance LED grow lights, creates lighting fixtures that enable previously unobtainable and unthinkable results. FOHSE’s sustainable and innovative first-of-their-kind products create a loyal customer base around the world. FOHSE was founded in 2015 and has sold multiple tens of thousands of lights to growers and cannabis brands around the world—without a single customer taking the company up on its promise of refund if their yields did not increase.

For media inquiries, please contact:PR@fohse.com [...]

June 16, 2024

Press ReleaseUnlocking Savings: FOHSE Introduces Energy Rebate Program Offering Up to 70% Rebate on LED Lighting for Cannabis Growers – FOHSE, a pioneering force in horticulture science and engineering for the cannabis market, announces an innovative State-to-State Energy Rebate Program aimed at revolutionizing the way cultivators approach lighting solutions. This initiative is set to transform the landscape of cannabis cultivation by offering unprecedented savings of up to 70% on retrofits from traditional HPS to cutting-edge LED lighting applications for your grow facility.

With the cannabis industry experiencing exponential growth, cultivators face substantial initial startup costs. FOHSE recognizes this challenge and has partnered with states across the nation to introduce and assist with game-changing rebate programs designed to alleviate financial burdens and accelerate the transition to energy-efficient LED lighting solutions.

CEO and Co-Founder of FOHSE, Brett Stevens, expresses profound enthusiasm for the program, stating, “We are thrilled to introduce these rebate programs to our valued clients. At FOHSE, we are committed to driving innovation and sustainability within the cannabis cultivation industry. By leveraging state-of-the-art LED lighting technology and collaborating with forward-thinking states, we are empowering cultivators to optimize their operations while significantly reducing their environmental footprint.”

The State-to-State Energy Rebate Program not only benefits cultivators but also delivers substantial advantages to participating states. By incentivizing the adoption of energy-efficient LED lighting, states can achieve significant reductions in energy consumption, enhance HVAC efficiencies, and promote sustainable practices within the cannabis industry. FOHSE constantly stands tall with some of the highest efficiency ratings in the industry, for their entire line of products.

Stevens emphasizes, “This initiative underscores our dedication to sustainability and environmental stewardship. By embracing LED lighting solutions, cultivators can achieve remarkable energy savings, enhance crop quality, and contribute to a greener future for all.”

FOHSE clients are poised to reap substantial rewards through the rebate program, with some eligible for even greater incentives. The program’s implementation marks a significant milestone in FOHSE’s ongoing mission to drive innovation and foster sustainability within the cannabis cultivation sector.

For more information and qualification details about FOHSE and its State-to-State Energy Rebate Program, please visit www.fohse.com or contact 888-364-7377 to connect with an LED lighting expert.

About FOHSE:

FOHSE, the Future of Horticultural Science & Engineering, a leading manufacturer of high-performance LED grow lights, creates lighting fixtures that enable previously unobtainable and unthinkable results. FOHSE’s sustainable and innovative first-of-their-kind products create a loyal customer base around the world. FOHSE was founded in 2015 and has sold multiple tens of thousands of lights to growers and cannabis brands around the world—without a single customer taking the company up on its promise of refund if their yields did not increase.

For media inquiries, please contact:PR@fohse.com [...]

June 16, 2024 Press ReleaseCanaQuest Announces Key Appointments to Team to Drive CQ-001 through Clinical TrialsTORONTO, ON, June 11, 2024 (GLOBE NEWSWIRE) — CanaQuest Medical Corp (“CanaQuest” or the “Company”) (OTC: CANQF), is pleased to announce strategic additions to its executive team with expertise in conducting clinical trials and US FDA drug approval success. The team plans to effectively navigate the regulatory approval process for Drug Candidate, CQ-001 (cannabidiol + proprietary API composition), to treat rare neurological conditions with a primary focus on epilepsy. Furthermore, a nutraceutical version of the formulation, Mentanine™, is scheduled for clinical studies to investigate its potential applications across various indications, paving the way for future clinical trials. [...]

June 13, 2024

Press ReleaseCanaQuest Announces Key Appointments to Team to Drive CQ-001 through Clinical TrialsTORONTO, ON, June 11, 2024 (GLOBE NEWSWIRE) — CanaQuest Medical Corp (“CanaQuest” or the “Company”) (OTC: CANQF), is pleased to announce strategic additions to its executive team with expertise in conducting clinical trials and US FDA drug approval success. The team plans to effectively navigate the regulatory approval process for Drug Candidate, CQ-001 (cannabidiol + proprietary API composition), to treat rare neurological conditions with a primary focus on epilepsy. Furthermore, a nutraceutical version of the formulation, Mentanine™, is scheduled for clinical studies to investigate its potential applications across various indications, paving the way for future clinical trials. [...]

June 13, 2024 Blog PostWhen to Automate Your Pre-Roll Production ProcessIf you’re a producer in the cannabis industry looking to scale up your pre-roll production, automation might be on your radar. But upgrading to automation is a major decision and expense, so how do you know when to take the leap?

Here’s a streamlined guide to help you decide if it’s time to automate and what to consider based on insights from the Pre-Roll Experts.

Assessing Production Needs

The decision to automate often starts with a simple calculation: comparing the monthly volume of pre-rolls you produce versus the labor costs involved in manual production.

Automated pre-roll machines, capable of producing thousands of pre-rolls per hour, become cost-effective when production reaches a significant volume. We don’t recommend upgrading to automation until your demand exceeds 50,000 pre-rolls monthly—a volume achieved by fewer than 10% of producers.

Choosing the Right Time and Type of Automation

Automation isn’t just about meeting production volumes; it also involves considering the types of products you’re creating.

If your product line includes multiple strains or varying pre-roll products, such as different sizes or types (like cones versus tubes), you might face challenges. Automated systems excel with consistent inputs and might struggle with variation, potentially increasing turnover time between batches.

If your products require frequent adjustments for making different SKUs within a single day, maintaining several tabletop cone filling machines might be more effective – and cheaper – than fully automating the process.

Pros and Cons of Pre-Roll Automation

Processed with VSCO with s3 preset

On the upside, automation can drastically reduce labor costs and improve consistency in product quality. Automated machines can handle tasks like filling, packing, and weighing with precision, potentially operating for hours with minimal human intervention. This efficiency can free up your workforce to focus on other aspects of production and packaging.

However, the transition to automation isn’t without its drawbacks. High initial costs can be prohibitive for smaller operations. Moreover, pre-roll machines require continuous monitoring and adjustments, debunking the myth of a “set it and forget it” solution.

Plus, the inherent variability in the stickiness and density of cannabis flower – not just strain to strain, but harvest to harvest – can make automated processing challenging, as machines prefer uniform inputs.

Automated pre-roll filling machines often also require additional training, so having a dedicated employee, potentially with an engineering background is helpful, so if your team has significant turnover, you may need to take the cost of re-training into consideration.

Other Considerations

There are a handful of other things to consider if you plan to automate your pre-roll production.

As mentioned, automated machines require a consistent particle size to work effectively, so if you do plan to upgrade to an automated pre-roll filling machine, it would behoove you to also have an industrial grinder and a sifter to ensure uniformity.

Manufacturers should also consider adding a humidor to their facility. Humidors provide a constant moisture level and storing ground flower helps maintain consistency of inputs before packing. Additionally, a humidor can be used to keep completed pre-rolls fresh prior to delivery at a dispensary, which is particularly helpful if you are producing large quantities.

Finally, make sure your pre-rolled cones are also consistent in their quality so they work in the automation process. The machine won’t realize if there are slight issues in the opening diameter or size of the cone and cannot adjust to make it work. Inconsistent, flimsy and other low-quality cones just aren’t going to be good enough to work with automated machinery.

Industry Trends and Growth

Understanding market trends can also help guide your decision. The pre-roll segment has seen substantial growth, driven by the lowering cost of cannabis and technological advancements in pre-roll manufacturing.

This growth indicates a robust market potential for pre-rolled products, suggesting that investing in automation could be a forward-thinking move if aligned with industry dynamics and consumer demand.

When to Automate Your Production

Deciding to automate your pre-roll production involves analyzing your current production capacity, market trends and the specific needs of your product line. While automation offers significant advantages in terms of efficiency and cost reduction, it requires careful consideration of the types and variations of pre-rolls you produce.

But with the right approach, automation can be a pivotal step in scaling your cannabis business to meet increasing market demands efficiently. [...]

May 21, 2024

Blog PostWhen to Automate Your Pre-Roll Production ProcessIf you’re a producer in the cannabis industry looking to scale up your pre-roll production, automation might be on your radar. But upgrading to automation is a major decision and expense, so how do you know when to take the leap?

Here’s a streamlined guide to help you decide if it’s time to automate and what to consider based on insights from the Pre-Roll Experts.

Assessing Production Needs

The decision to automate often starts with a simple calculation: comparing the monthly volume of pre-rolls you produce versus the labor costs involved in manual production.

Automated pre-roll machines, capable of producing thousands of pre-rolls per hour, become cost-effective when production reaches a significant volume. We don’t recommend upgrading to automation until your demand exceeds 50,000 pre-rolls monthly—a volume achieved by fewer than 10% of producers.

Choosing the Right Time and Type of Automation

Automation isn’t just about meeting production volumes; it also involves considering the types of products you’re creating.

If your product line includes multiple strains or varying pre-roll products, such as different sizes or types (like cones versus tubes), you might face challenges. Automated systems excel with consistent inputs and might struggle with variation, potentially increasing turnover time between batches.

If your products require frequent adjustments for making different SKUs within a single day, maintaining several tabletop cone filling machines might be more effective – and cheaper – than fully automating the process.

Pros and Cons of Pre-Roll Automation

Processed with VSCO with s3 preset

On the upside, automation can drastically reduce labor costs and improve consistency in product quality. Automated machines can handle tasks like filling, packing, and weighing with precision, potentially operating for hours with minimal human intervention. This efficiency can free up your workforce to focus on other aspects of production and packaging.

However, the transition to automation isn’t without its drawbacks. High initial costs can be prohibitive for smaller operations. Moreover, pre-roll machines require continuous monitoring and adjustments, debunking the myth of a “set it and forget it” solution.

Plus, the inherent variability in the stickiness and density of cannabis flower – not just strain to strain, but harvest to harvest – can make automated processing challenging, as machines prefer uniform inputs.

Automated pre-roll filling machines often also require additional training, so having a dedicated employee, potentially with an engineering background is helpful, so if your team has significant turnover, you may need to take the cost of re-training into consideration.

Other Considerations

There are a handful of other things to consider if you plan to automate your pre-roll production.

As mentioned, automated machines require a consistent particle size to work effectively, so if you do plan to upgrade to an automated pre-roll filling machine, it would behoove you to also have an industrial grinder and a sifter to ensure uniformity.

Manufacturers should also consider adding a humidor to their facility. Humidors provide a constant moisture level and storing ground flower helps maintain consistency of inputs before packing. Additionally, a humidor can be used to keep completed pre-rolls fresh prior to delivery at a dispensary, which is particularly helpful if you are producing large quantities.

Finally, make sure your pre-rolled cones are also consistent in their quality so they work in the automation process. The machine won’t realize if there are slight issues in the opening diameter or size of the cone and cannot adjust to make it work. Inconsistent, flimsy and other low-quality cones just aren’t going to be good enough to work with automated machinery.

Industry Trends and Growth

Understanding market trends can also help guide your decision. The pre-roll segment has seen substantial growth, driven by the lowering cost of cannabis and technological advancements in pre-roll manufacturing.

This growth indicates a robust market potential for pre-rolled products, suggesting that investing in automation could be a forward-thinking move if aligned with industry dynamics and consumer demand.

When to Automate Your Production

Deciding to automate your pre-roll production involves analyzing your current production capacity, market trends and the specific needs of your product line. While automation offers significant advantages in terms of efficiency and cost reduction, it requires careful consideration of the types and variations of pre-rolls you produce.

But with the right approach, automation can be a pivotal step in scaling your cannabis business to meet increasing market demands efficiently. [...]

May 21, 2024 Blog PostUnlocking the Secret to Superior Pre-Rolls: The Essential Step of SiftingIn the intricate art of crafting perfect pre-rolls, every stage in the production process plays a pivotal role. From grinding the cannabis to packing the final product, it’s crucial to put exceptional care into each step to ensure the quality and overall satisfaction with your product.

Still, there’s one critical stage of pre-roll production that is often overlooked: sifting. Despite its pivotal role in enhancing both the quality and efficiency of pre-rolled cones and pre-roll tubes, sifting is a step that is skipped by most pre-roll producers.

One recent study by Custom Cones USA revealed that only about 40% of cannabis companies use sifters in their pre-roll production. Whether or not you fall into that category, knowing more about sifting can help you craft superior pre-rolls and give yourself an edge over your competitors. Let’s explore why this step is indispensable in crafting quality pre-rolls.

Why Consistent Particle Size Matters

Sifting is not just a supplementary step; it’s a fundamental process that filters out unwanted stems and large particles which could compromise the structural integrity of your pre-rolls.

More than just cleaning the cannabis, sifting ensures that each particle is uniformly sized, leading to a smoother smoking experience and preventing issues such as uneven burning and airflow blockages. Inconsistencies in particle size can also lead to air pockets, which cause pre-rolls to burn unevenly, a common complaint among consumers.

Many automated pre-roll machines, such as the AuraX and AuraOne, require precise particle sizes to function efficiently, making sifting essential for maintaining a swift production line.

Scientific Backing of Sifting

Research supports the notion that a narrow particle size distribution enhances the flowability of materials. Sifting also plays a key role in maintaining the uniformity of pre-rolls. To underscore the importance of sifting, Custom Cones USA conducted an experiment comparing sifted versus sifted cannabis using an automatic sifter.

The results were revealing to say the least. Cannabis that was sifted before being added to rolling papers had a 65% lower weight variance and a dramatic reduction in defects caused by stems. The number of unsifted pre-rolls that had a hole due to stems was 488% higher than in sifted pre-rolls.

As markets mature and competition increases, sifting can help you maintain an edge by promising quality experience for consumers.

Sifting for Metering and Kief Collection

Sifting also plays a vital role in metering and kief collection. For operations that use metering trays in their filling machines, consistent particle size is essential for accurate volumetric filling, ensuring pre-rolled cones are packed with a consistent amount of cannabis.

Sifters can also be employed to collect kief, a potent byproduct composed of cannabis trichomes that have been knocked off the flower that is used as a concentrate or to make hash. By using mesh screens designed for kief extraction, you can collect kief to later mix back in to enhance the potency and flavor of your pre-rolls.

The Transformative Power of Sifting

Incorporating a meticulous sifting process in your pre-roll production is not just about refining what you remove from the cannabis; it’s about enhancing the overall quality and efficiency of the final product.

The impact of sifting extends through every aspect of production, from operational efficiency to consumer satisfaction. For those looking to elevate their pre-roll game, overlooking this crucial step could mean missing out on a significant improvement in product quality. [...]

May 13, 2024

Blog PostUnlocking the Secret to Superior Pre-Rolls: The Essential Step of SiftingIn the intricate art of crafting perfect pre-rolls, every stage in the production process plays a pivotal role. From grinding the cannabis to packing the final product, it’s crucial to put exceptional care into each step to ensure the quality and overall satisfaction with your product.

Still, there’s one critical stage of pre-roll production that is often overlooked: sifting. Despite its pivotal role in enhancing both the quality and efficiency of pre-rolled cones and pre-roll tubes, sifting is a step that is skipped by most pre-roll producers.

One recent study by Custom Cones USA revealed that only about 40% of cannabis companies use sifters in their pre-roll production. Whether or not you fall into that category, knowing more about sifting can help you craft superior pre-rolls and give yourself an edge over your competitors. Let’s explore why this step is indispensable in crafting quality pre-rolls.

Why Consistent Particle Size Matters

Sifting is not just a supplementary step; it’s a fundamental process that filters out unwanted stems and large particles which could compromise the structural integrity of your pre-rolls.

More than just cleaning the cannabis, sifting ensures that each particle is uniformly sized, leading to a smoother smoking experience and preventing issues such as uneven burning and airflow blockages. Inconsistencies in particle size can also lead to air pockets, which cause pre-rolls to burn unevenly, a common complaint among consumers.

Many automated pre-roll machines, such as the AuraX and AuraOne, require precise particle sizes to function efficiently, making sifting essential for maintaining a swift production line.

Scientific Backing of Sifting

Research supports the notion that a narrow particle size distribution enhances the flowability of materials. Sifting also plays a key role in maintaining the uniformity of pre-rolls. To underscore the importance of sifting, Custom Cones USA conducted an experiment comparing sifted versus sifted cannabis using an automatic sifter.

The results were revealing to say the least. Cannabis that was sifted before being added to rolling papers had a 65% lower weight variance and a dramatic reduction in defects caused by stems. The number of unsifted pre-rolls that had a hole due to stems was 488% higher than in sifted pre-rolls.

As markets mature and competition increases, sifting can help you maintain an edge by promising quality experience for consumers.

Sifting for Metering and Kief Collection

Sifting also plays a vital role in metering and kief collection. For operations that use metering trays in their filling machines, consistent particle size is essential for accurate volumetric filling, ensuring pre-rolled cones are packed with a consistent amount of cannabis.

Sifters can also be employed to collect kief, a potent byproduct composed of cannabis trichomes that have been knocked off the flower that is used as a concentrate or to make hash. By using mesh screens designed for kief extraction, you can collect kief to later mix back in to enhance the potency and flavor of your pre-rolls.

The Transformative Power of Sifting

Incorporating a meticulous sifting process in your pre-roll production is not just about refining what you remove from the cannabis; it’s about enhancing the overall quality and efficiency of the final product.

The impact of sifting extends through every aspect of production, from operational efficiency to consumer satisfaction. For those looking to elevate their pre-roll game, overlooking this crucial step could mean missing out on a significant improvement in product quality. [...]

May 13, 2024 Blog PostDaySavers Elevates the Pre-Roll Experience with Carefully Crafted Pre Rolled ConesIn the realm of cannabis consumption, the quality of the smoking experience hinges on the products used. For consumers, that typically means carefully parsing through the various strains and flower types that will elevate their smoke session.

But when it comes to pre-rolls, consumers are often at the mercy of the products available at their dispensary – which leaves much to be desired when it comes to quality and range of choices. DaySavers is aiming to change that.

DaySavers, the new direct to consumer brand founded by pre-roll manufacturer Custom Cones USA, offers a wide selection of pre-roll products and smoking accessories. Their goal? To save the day for cannabis consumers by providing pre rolled cones and products that are not only superior but also rigorously tested and approved. Let’s delve into what separates DaySavers pre-roll products from the rest.

Pre Rolled Cones and Smoking Accessories

When Custom Cones USA launched their direct-to-consumer brand DaySavers in 2023, they aimed to use their expertise and industry knowledge to raise the standard of pre-roll products.

The result is a wide product range that includes pre rolled cones and tubes that are designed to enhance the user experience. From the pristine clarity of ultra-refined white pre rolled cones to the earthy appeal of natural brown rolling papers, DaySavers delivers an extensive range of pre-roll options for consumers of every preference.

DaySavers also has a wide selection of smoking accessories to help consumers personalize their smoking experience. They offer innovative products that cater to the diverse tastes of cannabis users, including spiral, wood, and premium filter tips and the pre-rolled hemp wrap blunts at Fill-a Blunts.

DaySavers represents more than just a brand—it embodies a collective effort fueled by industry experts, growers, budtenders, creators, and passionate consumers. Each pre-rolled cone undergoes meticulous review and approval by the DaySavers Panel, ensuring stringent criteria for quality and performance are met. This commitment to transparency and excellence underscores DaySavers’ mission to be the most honest, transparent, and compliant rolling paper company in the world.

Compliance and Safety Standards

DaySavers places paramount importance on consumer safety by subjecting their pre rolled cones and tubes to rigorous testing for heavy metals, pesticides, and microbials. This ensures that every product meets the highest industry standards, providing peace of mind to consumers who prioritize transparency and quality.

Their adherence to strict testing standards is a welcome change in the pre-roll industry, which has been plagued by contaminants like pesticides and heavy metals. A recent study conducted by SC Labs revealed that 90% of 118 rolling paper products contained at least one heavy metal. The same study also revealed that 8% of those products exceed California’s limit for cannabis products, which are among the strictest in the U.S. California officials also recently issued a mandatory recall on pre-rolls due to the presence of mold, pulling products from nearly 100 dispensaries.

Unlike some alternatives that may pose health risks due to contaminants, DaySavers products are backed by documented testing. All of the pre rolled cones and tubes are FSC certified, reaffirming their dedication to safety and excellence. To ensure only the highest quality products reach their customers, DaySavers also created an expert panel to review and test each item. The DaySavers Expert Panel is a group of cannabis aficionados who review and approve every product sold on their website, giving consumers an added layer of confidence in all their items.

Experience the DaySavers Difference

Beyond their dedication to quality products, DaySavers is committed to fostering a vibrant community of like-minded individuals who share a passion for cannabis and creativity. By prioritizing consumer safety and community engagement, DaySavers has solidified its position as a trusted brand that cannabis enthusiasts can rely on and celebrate.Ready to explore premium pre rolled cones that elevate your smoking experience to new heights? Check out the DaySavers website to explore their full range of pre roll products and smoking accessories [...]

May 6, 2024

Blog PostDaySavers Elevates the Pre-Roll Experience with Carefully Crafted Pre Rolled ConesIn the realm of cannabis consumption, the quality of the smoking experience hinges on the products used. For consumers, that typically means carefully parsing through the various strains and flower types that will elevate their smoke session.

But when it comes to pre-rolls, consumers are often at the mercy of the products available at their dispensary – which leaves much to be desired when it comes to quality and range of choices. DaySavers is aiming to change that.

DaySavers, the new direct to consumer brand founded by pre-roll manufacturer Custom Cones USA, offers a wide selection of pre-roll products and smoking accessories. Their goal? To save the day for cannabis consumers by providing pre rolled cones and products that are not only superior but also rigorously tested and approved. Let’s delve into what separates DaySavers pre-roll products from the rest.

Pre Rolled Cones and Smoking Accessories

When Custom Cones USA launched their direct-to-consumer brand DaySavers in 2023, they aimed to use their expertise and industry knowledge to raise the standard of pre-roll products.

The result is a wide product range that includes pre rolled cones and tubes that are designed to enhance the user experience. From the pristine clarity of ultra-refined white pre rolled cones to the earthy appeal of natural brown rolling papers, DaySavers delivers an extensive range of pre-roll options for consumers of every preference.

DaySavers also has a wide selection of smoking accessories to help consumers personalize their smoking experience. They offer innovative products that cater to the diverse tastes of cannabis users, including spiral, wood, and premium filter tips and the pre-rolled hemp wrap blunts at Fill-a Blunts.

DaySavers represents more than just a brand—it embodies a collective effort fueled by industry experts, growers, budtenders, creators, and passionate consumers. Each pre-rolled cone undergoes meticulous review and approval by the DaySavers Panel, ensuring stringent criteria for quality and performance are met. This commitment to transparency and excellence underscores DaySavers’ mission to be the most honest, transparent, and compliant rolling paper company in the world.

Compliance and Safety Standards

DaySavers places paramount importance on consumer safety by subjecting their pre rolled cones and tubes to rigorous testing for heavy metals, pesticides, and microbials. This ensures that every product meets the highest industry standards, providing peace of mind to consumers who prioritize transparency and quality.

Their adherence to strict testing standards is a welcome change in the pre-roll industry, which has been plagued by contaminants like pesticides and heavy metals. A recent study conducted by SC Labs revealed that 90% of 118 rolling paper products contained at least one heavy metal. The same study also revealed that 8% of those products exceed California’s limit for cannabis products, which are among the strictest in the U.S. California officials also recently issued a mandatory recall on pre-rolls due to the presence of mold, pulling products from nearly 100 dispensaries.

Unlike some alternatives that may pose health risks due to contaminants, DaySavers products are backed by documented testing. All of the pre rolled cones and tubes are FSC certified, reaffirming their dedication to safety and excellence. To ensure only the highest quality products reach their customers, DaySavers also created an expert panel to review and test each item. The DaySavers Expert Panel is a group of cannabis aficionados who review and approve every product sold on their website, giving consumers an added layer of confidence in all their items.

Experience the DaySavers Difference

Beyond their dedication to quality products, DaySavers is committed to fostering a vibrant community of like-minded individuals who share a passion for cannabis and creativity. By prioritizing consumer safety and community engagement, DaySavers has solidified its position as a trusted brand that cannabis enthusiasts can rely on and celebrate.Ready to explore premium pre rolled cones that elevate your smoking experience to new heights? Check out the DaySavers website to explore their full range of pre roll products and smoking accessories [...]

May 6, 2024 Press ReleaseVPR Brands LP Reports Record Annual Financial Performance for Fiscal Year 2023The Company Concluded the Year With Revenue Doubling, Alongside Substantial Improvements in Gross Profit Margins and Net Income

FORT LAUDERDALE, FL, April 19, 2024 (GLOBE NEWSWIRE) — via NewMediaWire – VPR Brands LP (OTCQB: VPRB), a leader in the innovation and monetization of intellectual properties within the electronic cigarette and vaporizer sector, today announced its financial results for the fiscal year ended December 31, 2023. Demonstrating significant growth and enhanced operational efficiency, the company concluded the year with revenue doubling, alongside substantial improvements in gross profit margins and net income.

Annual Financial Highlights:

● Revenues: Increased significantly to $9,853,825, up from $4,927,616 in 2022. The growth is attributed to increased customer sales and the introduction of new royalty revenue streams.

● Net Income: Reported a net income of $3,812,605, reversing a net loss of $203,697 in 2022, showcasing the company’s effective strategies and operational execution.

● Cost of Sales: Rose to $4,972,497, reflecting the increased sales volume, with gross margins impressively expanding to 50.3% in 2023 from 33% in 2022, driven by higher-margin direct-to-consumer online sales and higher wholesale margins.

● Operating Expenses: Increased to $2,210,072 as compared to $1,828,195 in 2022 due to enhanced advertising activities and additional advertising to support the expanded sales and revenue base.

● Cash Flow from Operations: Improved to a positive $3,481,356 in 2023 from a negative $312,423 in 2022, indicating robust operational health and enhanced cash management.

Liquidity and Capital Resources:

● Total Assets: Grew to $3,191,246 from $1,632,528 in 2022, bolstered by increased Cash, Inventory, and Accounts Receivable from the growth in sales.

● Total Liabilities: Decreased to $2,576,936 from $3,951,020 in 2022, significantly reducing the company’s debt profile and enhancing financial stability.

Other Financial Updates:

● Other Income: Other income netted $1,141,350 in 2023, mainly from a litigation settlement which contributed $2,400,172.

● Financing Activities: Net cash used in financing activities was $1,706,517 in 2023, a pivot from net cash provided of $332,254 in 2022, reflecting a strategic reduction in debt levels.

Executive Comments:

Kevin Frija, CEO of VPR Brands LP, stated, “2023 was a pivotal year for VPR Brands. We’ve successfully optimized our patent and trademark portfolio and expanded our market presence, resulting in historic revenue levels and profitability. Our strategic focus on Intellectual Property Monetization, including licensing has positioned us strongly within the competitive landscape.”

Dan Hoff, COO, added, “Our operational achievements this year reflect our commitment to excellence and innovation. With new products in the pipeline and an expanding rapidly into new segments through licensing, we are poised for continued growth, diversification and are focused on delivering sustainable value to our shareholders.”

About VPR Brands LP:

VPR Brands is a technology company and an IP holding company engaged in various monetization strategies of its U.S. patents covering electronic cigarette, vaporizer technologies, and related accessories. The company designs, develops, markets, and distributes products oriented towards the cannabis markets, including the ELF and HONEYSTICK brand of vaporizers and DISSIM Lighters. VPR Brands is actively enforcing its patents and exploring and monetizing licensing opportunities.

For more information about VPR Brands, please visit www.vprbrands.com

Forward-Looking Statements:

This news release contains statements that involve expectations, plans, or intentions, and other factors discussed from time to time in the company’s Securities and Exchange Commission filings. These statements are forward-looking and are subject to risks and uncertainties, so actual results may vary materially. The company cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. The company disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Products from VPR Brands, a publicly traded company (VPRB) ● 888.420.8858

Investor Information [...]

May 1, 2024

Press ReleaseVPR Brands LP Reports Record Annual Financial Performance for Fiscal Year 2023The Company Concluded the Year With Revenue Doubling, Alongside Substantial Improvements in Gross Profit Margins and Net Income

FORT LAUDERDALE, FL, April 19, 2024 (GLOBE NEWSWIRE) — via NewMediaWire – VPR Brands LP (OTCQB: VPRB), a leader in the innovation and monetization of intellectual properties within the electronic cigarette and vaporizer sector, today announced its financial results for the fiscal year ended December 31, 2023. Demonstrating significant growth and enhanced operational efficiency, the company concluded the year with revenue doubling, alongside substantial improvements in gross profit margins and net income.

Annual Financial Highlights:

● Revenues: Increased significantly to $9,853,825, up from $4,927,616 in 2022. The growth is attributed to increased customer sales and the introduction of new royalty revenue streams.

● Net Income: Reported a net income of $3,812,605, reversing a net loss of $203,697 in 2022, showcasing the company’s effective strategies and operational execution.

● Cost of Sales: Rose to $4,972,497, reflecting the increased sales volume, with gross margins impressively expanding to 50.3% in 2023 from 33% in 2022, driven by higher-margin direct-to-consumer online sales and higher wholesale margins.

● Operating Expenses: Increased to $2,210,072 as compared to $1,828,195 in 2022 due to enhanced advertising activities and additional advertising to support the expanded sales and revenue base.

● Cash Flow from Operations: Improved to a positive $3,481,356 in 2023 from a negative $312,423 in 2022, indicating robust operational health and enhanced cash management.

Liquidity and Capital Resources:

● Total Assets: Grew to $3,191,246 from $1,632,528 in 2022, bolstered by increased Cash, Inventory, and Accounts Receivable from the growth in sales.

● Total Liabilities: Decreased to $2,576,936 from $3,951,020 in 2022, significantly reducing the company’s debt profile and enhancing financial stability.

Other Financial Updates:

● Other Income: Other income netted $1,141,350 in 2023, mainly from a litigation settlement which contributed $2,400,172.

● Financing Activities: Net cash used in financing activities was $1,706,517 in 2023, a pivot from net cash provided of $332,254 in 2022, reflecting a strategic reduction in debt levels.

Executive Comments:

Kevin Frija, CEO of VPR Brands LP, stated, “2023 was a pivotal year for VPR Brands. We’ve successfully optimized our patent and trademark portfolio and expanded our market presence, resulting in historic revenue levels and profitability. Our strategic focus on Intellectual Property Monetization, including licensing has positioned us strongly within the competitive landscape.”

Dan Hoff, COO, added, “Our operational achievements this year reflect our commitment to excellence and innovation. With new products in the pipeline and an expanding rapidly into new segments through licensing, we are poised for continued growth, diversification and are focused on delivering sustainable value to our shareholders.”

About VPR Brands LP:

VPR Brands is a technology company and an IP holding company engaged in various monetization strategies of its U.S. patents covering electronic cigarette, vaporizer technologies, and related accessories. The company designs, develops, markets, and distributes products oriented towards the cannabis markets, including the ELF and HONEYSTICK brand of vaporizers and DISSIM Lighters. VPR Brands is actively enforcing its patents and exploring and monetizing licensing opportunities.

For more information about VPR Brands, please visit www.vprbrands.com

Forward-Looking Statements:

This news release contains statements that involve expectations, plans, or intentions, and other factors discussed from time to time in the company’s Securities and Exchange Commission filings. These statements are forward-looking and are subject to risks and uncertainties, so actual results may vary materially. The company cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. The company disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Products from VPR Brands, a publicly traded company (VPRB) ● 888.420.8858

Investor Information [...]

May 1, 2024 Q&A InterviewStar Micronics Brings Mainstream POS Best Practices to the Niche Cannabis IndustryIf you’ve worked with POS systems before, you’ve likely heard of Star Micronics, the world’s leader in innovative POS solutions that empower global businesses to properly manage their revenue and streamline operations to provide stellar customer service every time.

The company moved into cannabis early in the game—one of the first mainstream POS providers to do so, despite the stigma that still surrounded the plant at the time. They were determined to enter the space and add value based on their decades of expert experience with a wide variety of global retailers. And from streamlined printer solutions that boost dispensaries’ customer service skills to inventory tracking data and analytics that speed up the selling and ordering process, they’ve done just that.

We sat down with Star’s Product Integration Manager, Mark Rasho, to learn more about the company’s secrets to success, the unique innovations they’ve introduced to the cannabis industry, and how they plan to keep pioneering how POS is approached by retail operators nationwide.

Leafwire: How did Star Micronics first begin supporting the cannabis industry?

Mark Rasho: We got into cannabis pretty early on; we were probably one of the first hardware providers to get into the field. We started by developing integrated POS scales for cannabis operators—inventory-focused scales that are being used from seed to sale across the vertical.

Today, our POS tools are found in about 90 percent of the nation’s legal dispensaries. Operators can use them to measure and weigh products, put them into the system, and move them to the next stage of the supply chain.

LW: What informed your initial decision to move into cannabis?

MR: It was a new industry popping up that needed our products. It was very logical and straightforward for us to get into. Some of our competitors were hesitant about getting into the field, but we weren’t. We saw an industry in need of things like scales, scanners, cash drawers, printers, label printers, tablet stands, and kiosk stands. We had all of that available, so it was a natural next step for us.

LW: What is unique about your dispensary support compared to the rest of your mainstream clients?

MR: It’s funny; we actually began developing a lot of our newest products with the cannabis industry in mind. For example, our new mC-Label3 printer, which prints linerless labels, features a motor and blade designed to cut labels quickly for easy labeling and sticking on products, and that need came from our cannabis clients.

LW: How so?

MR: It was the influx of online orders that first brought this to our attention, which really kicked in during the pandemic. At the time, you’d see a lot of receipts stapled to order bags, which someone had to do manually.

With linerless labels, you can just take the sticker from the printer and slap it on. It has all of the necessary information printed for seamless delivery and pickup, and helps operators and consumers alike be much more efficient with their sales and purchases.

LW: How else do you make operators’ lives easier?

MR: Our scales. They’re NTEP-certified for U.S. operators and Measurement Canada-certified for operators up north, and they’re great at helping operators stay compliant while also working efficiently and boosting revenue. We’ve also developed a number of portable printer solutions you can easily strap onto your body or belt buckle, which helps sellers complete their tasks quicker and easier.

We don’t want to make products to sell—we want to create solutions that will inspire the industry to work more efficiently.

LW: What advice would you give an operator on the hunt for a new POS system?

MR: You’re going to want to look for a POS system that is able to accept online orders and also integrates with other online ordering apps like Weedmaps or Leafly. You also want something with receipts, scanners, and a label machine integrated: a full POS solution so you don’t have to work with a bunch of different vendors or dedicate one POS for sales and another for online orders. It’s best to stick with one solution if you can.

I’d also recommend looking into a standalone printer in the back for receiving online orders. Star offers CloudPRNT technology; if you opt for a CloudPRNT-compatible printer, it will pull from the server automatically instead of waiting to start printing. So, your printer will see the job in the queue, automatically pull it in, and print.

This will streamline the process for you and your staff–you don’t have to accept an order before it prints. It just does so automatically, so whoever is in the back filling orders can see it going, grab that receipt, and start putting the products together for the customer. This process has helped restaurants and other retailers streamline their online ordering, so it would similarly make sense for cannabis operators.

LW: What’s on the horizon for Star Micronics?

MR: We’ll be coming out with a new version of our CloudPRNT printers. The machines will be faster, with the ability to print labels and receipts. They’ll also feature new hardware, including USB-C for iOS, Android, and Windows. USB-C is better at transferring information data, printing quickly, and charging all connected devices while it works.

This update will be particularly beneficial for kiosks at dispensaries. Customers will be able to check out the menu, order what they want, and have the printer print out their receipt while they wait for the order. It does away with the need for Bluetooth, which is less reliable than direct connections. [...]

January 25, 2024

Q&A InterviewStar Micronics Brings Mainstream POS Best Practices to the Niche Cannabis IndustryIf you’ve worked with POS systems before, you’ve likely heard of Star Micronics, the world’s leader in innovative POS solutions that empower global businesses to properly manage their revenue and streamline operations to provide stellar customer service every time.

The company moved into cannabis early in the game—one of the first mainstream POS providers to do so, despite the stigma that still surrounded the plant at the time. They were determined to enter the space and add value based on their decades of expert experience with a wide variety of global retailers. And from streamlined printer solutions that boost dispensaries’ customer service skills to inventory tracking data and analytics that speed up the selling and ordering process, they’ve done just that.

We sat down with Star’s Product Integration Manager, Mark Rasho, to learn more about the company’s secrets to success, the unique innovations they’ve introduced to the cannabis industry, and how they plan to keep pioneering how POS is approached by retail operators nationwide.

Leafwire: How did Star Micronics first begin supporting the cannabis industry?

Mark Rasho: We got into cannabis pretty early on; we were probably one of the first hardware providers to get into the field. We started by developing integrated POS scales for cannabis operators—inventory-focused scales that are being used from seed to sale across the vertical.

Today, our POS tools are found in about 90 percent of the nation’s legal dispensaries. Operators can use them to measure and weigh products, put them into the system, and move them to the next stage of the supply chain.

LW: What informed your initial decision to move into cannabis?

MR: It was a new industry popping up that needed our products. It was very logical and straightforward for us to get into. Some of our competitors were hesitant about getting into the field, but we weren’t. We saw an industry in need of things like scales, scanners, cash drawers, printers, label printers, tablet stands, and kiosk stands. We had all of that available, so it was a natural next step for us.

LW: What is unique about your dispensary support compared to the rest of your mainstream clients?

MR: It’s funny; we actually began developing a lot of our newest products with the cannabis industry in mind. For example, our new mC-Label3 printer, which prints linerless labels, features a motor and blade designed to cut labels quickly for easy labeling and sticking on products, and that need came from our cannabis clients.

LW: How so?

MR: It was the influx of online orders that first brought this to our attention, which really kicked in during the pandemic. At the time, you’d see a lot of receipts stapled to order bags, which someone had to do manually.

With linerless labels, you can just take the sticker from the printer and slap it on. It has all of the necessary information printed for seamless delivery and pickup, and helps operators and consumers alike be much more efficient with their sales and purchases.

LW: How else do you make operators’ lives easier?

MR: Our scales. They’re NTEP-certified for U.S. operators and Measurement Canada-certified for operators up north, and they’re great at helping operators stay compliant while also working efficiently and boosting revenue. We’ve also developed a number of portable printer solutions you can easily strap onto your body or belt buckle, which helps sellers complete their tasks quicker and easier.

We don’t want to make products to sell—we want to create solutions that will inspire the industry to work more efficiently.

LW: What advice would you give an operator on the hunt for a new POS system?

MR: You’re going to want to look for a POS system that is able to accept online orders and also integrates with other online ordering apps like Weedmaps or Leafly. You also want something with receipts, scanners, and a label machine integrated: a full POS solution so you don’t have to work with a bunch of different vendors or dedicate one POS for sales and another for online orders. It’s best to stick with one solution if you can.

I’d also recommend looking into a standalone printer in the back for receiving online orders. Star offers CloudPRNT technology; if you opt for a CloudPRNT-compatible printer, it will pull from the server automatically instead of waiting to start printing. So, your printer will see the job in the queue, automatically pull it in, and print.

This will streamline the process for you and your staff–you don’t have to accept an order before it prints. It just does so automatically, so whoever is in the back filling orders can see it going, grab that receipt, and start putting the products together for the customer. This process has helped restaurants and other retailers streamline their online ordering, so it would similarly make sense for cannabis operators.

LW: What’s on the horizon for Star Micronics?

MR: We’ll be coming out with a new version of our CloudPRNT printers. The machines will be faster, with the ability to print labels and receipts. They’ll also feature new hardware, including USB-C for iOS, Android, and Windows. USB-C is better at transferring information data, printing quickly, and charging all connected devices while it works.

This update will be particularly beneficial for kiosks at dispensaries. Customers will be able to check out the menu, order what they want, and have the printer print out their receipt while they wait for the order. It does away with the need for Bluetooth, which is less reliable than direct connections. [...]

January 25, 2024 Q&A InterviewAzuca Brings Fast-Acting Formulations That Will Reinvent How Cannabis Edibles are ConsumedCannabis edibles are an increasingly popular category among consumers, but one major drawback to this form of consumption is its onset time. Effects can vary so widely from person to person, and that unpredictability has kept a lot of people away from the edible sector entirely.

Azuca serves edibles and beverage manufacturers with fast-acting delivery systems and advanced formulations that directly combat this stigma, allowing consumers to have a stronger grasp on how much they’re consuming and when it will take effect. With chef-created, science-forward products powered by its patent-pending TiME INFUSION® process, Azuca’s products encapsulate individual cannabinoid molecules, making them “water-friendly,” for a predictable and controllable experience every time.

We sat down with Azuca CEO and co-founder Kim Sanchez Rael to discuss the details of the company and the unique innovation they bring to cannabis edibles throughout the nation.

Leafwire: How was Azuca first formed?

Kim Sanchez Rael: NYC-based Bubby’s Chef and Owner Ron Silver and I started working together in 2017 and launched Azuca in 2018. Prior to the opening, Ron realized the industry’s biggest issue was the lack of controllable, fast-acting and reliable edibles. As a chef and culinary innovator, Ron leveraged his love of both food and cannabis to solve the challenges of cannabis edibles, and he spent several years developing what is now our TiME INFUSION® process. Our solution has been revolutionary, filling a void in the industry, and we continue to transform the category with our groundbreaking delivery systems.

LW: What is TiME INFUSION®?

KSR: TiME is a science-forward, chef-created encapsulation process that enables cannabinoids to be absorbed in the soft tissues of the digestive tract. This process preempts the first-pass liver metabolism and delivers Delta-9 THC directly to the body. This is very different, both in terms of onset time and in effect from the 11-Hydroxy-THC experience of traditional edibles that are metabolized by the liver.

LW: What sector of the industry does the company service?

KSR: We help edibles brands and manufacturers make their products the very best in the industry. We do this by licensing our cutting-edge advanced formulations for beverages, edibles, and topical cannabis products, setting new standards for excellence in quality and efficacy. Our formulations transform high-maintenance cannabinoids into chef-ready ingredients for edible and beverage manufacturers and brands, creating products that are both fast-acting and delicious. Our partnership model is completely scalable and empowers our brand partners to control their production process.

LW: What are the main benefits of your infusions for edible consumers?

KSR: For consumers, Azuca’s TiME INFUSION® delivers great-tasting edibles that act fast. There is no guessing game as first effects are felt in 5-15 minutes. Our process encapsulates cannabis oil molecules, transforming them into hydrophilic (water-friendly) cannabinoids that can be absorbed in the soft tissues of the mouth, esophagus and digestive system. By preempting the first pass metabolism, TiME INFUSION® allows for greater Delta-9 THC absorption – providing a more euphoric high – typically associated with inhalation, instead of the heavy, couch-lock high from traditional edibles. (Read more on the difference between Delta-9 THC and 11-Hydroxy-THC here.) There is also no bitter, medicinal, grassy/hemp after-taste. These effects are attractive to both existing cannabis consumers looking for an alternative to smoking, as well as new cannabis consumers who may have heard stories about unpleasant or unpredictable edibles experiences

LW: What about for edible manufacturers?

KSR: For manufacturers, our process is simple, stable and completely scalable for companies of any size. The solution helps companies save money—it is easy to use, easy to store, and easy to implement, so our partners can quickly bring best-in-class solutions to their customers. Azuca can be incorporated into existing manufacturing processes, doesn’t require moving product or equipment across state lines and helps reduce active ingredient waste up to 65 percent (more here).

Also, of note for cultivators and manufacturers is our newest innovation: Whole-Plant ACTiVATOR®, which allows for edibles without extracts. This entirely new category of edibles and beverages uses whole cannabis flower as infusion material and delivers the true inflorescence of unique strains including cannabinoids, terpenes, and flavonoids. A first in the industry, Azuca’s process doesn’t require traditional extraction and the only solvent used is water, offering a significant reduction in processing costs and a natural approach to ingestible infusions. In addition to fast-onset, products can be made without any additional flavoring, highlighting each strain’s unique sensory effects and flavor.

LW: Any upcoming news for Azuca?

KSR: We’re launching our “pay-it-forward” social equity initiative. We recently named Azuca’s first Social Equity Fellow—rising star Matha Figaro, CEO of ButACake. We’ve already worked with ButACake to bring their Hibiscus Elixir to Delaware’s medical market, utilizing Azuca’s new RTD ACTiVATOR® (“Ready to Drink”.) They’ve since launched a Peach Elixir, and fast-acting baked goods. We’ll be formally announcing our partnership and plans for 2024 with CannPowerment so even more licensed minority and women-owned businesses can benefit from TiME INFUSION®, giving them a competitive edge in the market and the opportunity to scale sustainability.

We will continue to innovate in the ingestibles category and expand globally. We’re already in over 100 SKUs, including whole-plant edibles and ready-to-drink beverages, in over 20 states plus Puerto Rico, across the US, Canada, and soon Australia. [...]

November 15, 2023

Q&A InterviewAzuca Brings Fast-Acting Formulations That Will Reinvent How Cannabis Edibles are ConsumedCannabis edibles are an increasingly popular category among consumers, but one major drawback to this form of consumption is its onset time. Effects can vary so widely from person to person, and that unpredictability has kept a lot of people away from the edible sector entirely.

Azuca serves edibles and beverage manufacturers with fast-acting delivery systems and advanced formulations that directly combat this stigma, allowing consumers to have a stronger grasp on how much they’re consuming and when it will take effect. With chef-created, science-forward products powered by its patent-pending TiME INFUSION® process, Azuca’s products encapsulate individual cannabinoid molecules, making them “water-friendly,” for a predictable and controllable experience every time.

We sat down with Azuca CEO and co-founder Kim Sanchez Rael to discuss the details of the company and the unique innovation they bring to cannabis edibles throughout the nation.

Leafwire: How was Azuca first formed?

Kim Sanchez Rael: NYC-based Bubby’s Chef and Owner Ron Silver and I started working together in 2017 and launched Azuca in 2018. Prior to the opening, Ron realized the industry’s biggest issue was the lack of controllable, fast-acting and reliable edibles. As a chef and culinary innovator, Ron leveraged his love of both food and cannabis to solve the challenges of cannabis edibles, and he spent several years developing what is now our TiME INFUSION® process. Our solution has been revolutionary, filling a void in the industry, and we continue to transform the category with our groundbreaking delivery systems.

LW: What is TiME INFUSION®?

KSR: TiME is a science-forward, chef-created encapsulation process that enables cannabinoids to be absorbed in the soft tissues of the digestive tract. This process preempts the first-pass liver metabolism and delivers Delta-9 THC directly to the body. This is very different, both in terms of onset time and in effect from the 11-Hydroxy-THC experience of traditional edibles that are metabolized by the liver.

LW: What sector of the industry does the company service?

KSR: We help edibles brands and manufacturers make their products the very best in the industry. We do this by licensing our cutting-edge advanced formulations for beverages, edibles, and topical cannabis products, setting new standards for excellence in quality and efficacy. Our formulations transform high-maintenance cannabinoids into chef-ready ingredients for edible and beverage manufacturers and brands, creating products that are both fast-acting and delicious. Our partnership model is completely scalable and empowers our brand partners to control their production process.

LW: What are the main benefits of your infusions for edible consumers?

KSR: For consumers, Azuca’s TiME INFUSION® delivers great-tasting edibles that act fast. There is no guessing game as first effects are felt in 5-15 minutes. Our process encapsulates cannabis oil molecules, transforming them into hydrophilic (water-friendly) cannabinoids that can be absorbed in the soft tissues of the mouth, esophagus and digestive system. By preempting the first pass metabolism, TiME INFUSION® allows for greater Delta-9 THC absorption – providing a more euphoric high – typically associated with inhalation, instead of the heavy, couch-lock high from traditional edibles. (Read more on the difference between Delta-9 THC and 11-Hydroxy-THC here.) There is also no bitter, medicinal, grassy/hemp after-taste. These effects are attractive to both existing cannabis consumers looking for an alternative to smoking, as well as new cannabis consumers who may have heard stories about unpleasant or unpredictable edibles experiences

LW: What about for edible manufacturers?

KSR: For manufacturers, our process is simple, stable and completely scalable for companies of any size. The solution helps companies save money—it is easy to use, easy to store, and easy to implement, so our partners can quickly bring best-in-class solutions to their customers. Azuca can be incorporated into existing manufacturing processes, doesn’t require moving product or equipment across state lines and helps reduce active ingredient waste up to 65 percent (more here).

Also, of note for cultivators and manufacturers is our newest innovation: Whole-Plant ACTiVATOR®, which allows for edibles without extracts. This entirely new category of edibles and beverages uses whole cannabis flower as infusion material and delivers the true inflorescence of unique strains including cannabinoids, terpenes, and flavonoids. A first in the industry, Azuca’s process doesn’t require traditional extraction and the only solvent used is water, offering a significant reduction in processing costs and a natural approach to ingestible infusions. In addition to fast-onset, products can be made without any additional flavoring, highlighting each strain’s unique sensory effects and flavor.

LW: Any upcoming news for Azuca?

KSR: We’re launching our “pay-it-forward” social equity initiative. We recently named Azuca’s first Social Equity Fellow—rising star Matha Figaro, CEO of ButACake. We’ve already worked with ButACake to bring their Hibiscus Elixir to Delaware’s medical market, utilizing Azuca’s new RTD ACTiVATOR® (“Ready to Drink”.) They’ve since launched a Peach Elixir, and fast-acting baked goods. We’ll be formally announcing our partnership and plans for 2024 with CannPowerment so even more licensed minority and women-owned businesses can benefit from TiME INFUSION®, giving them a competitive edge in the market and the opportunity to scale sustainability.

We will continue to innovate in the ingestibles category and expand globally. We’re already in over 100 SKUs, including whole-plant edibles and ready-to-drink beverages, in over 20 states plus Puerto Rico, across the US, Canada, and soon Australia. [...]

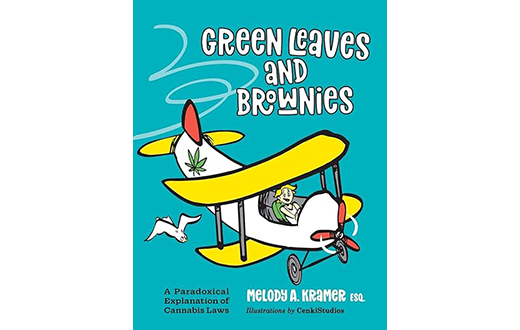

November 15, 2023 Q&A InterviewMelody Kramer’s Green Leaves and Brownies Teaches Cannabis Law à la Dr. SeussThe cannabis industry has been notoriously confusing when it comes to rules and regulations, largely due to the fact that it remains federally illegal. This continued status means cannabis law varies widely from region to region, and operators are required to jump through countless, ever-changing hoops just to remain compliant.

Trial lawyer and writer Melody A. Kramer has familiarized herself with cannabis law enough to know how complicated it can get, and that realization has fueled her latest effort and passion: writing Green Leaves and Brownies: A Paradoxical Explanation of Cannabis Laws, a lighthearted, Dr. Seuss-style book that educates people on the ins and outs of the plant from a court perspective.

Leafwire: How did you first found your law practice?

Melody Kramer: I loved the intellectual exercise of sorting out legal problems. One of my middle school history teachers used to read the class case facts and have us guess the legal outcome. I tended to guess an outcome entirely different than everyone else in the class—however, it was always the right one.

I was also inspired by my uncle, Wilfried Kramer. He wasn’t a lawyer and didn’t even have a college degree, but he worked his way up to be the Clerk for the Third District Court of Appeals in Sacramento. I loved hearing about his cases; it helped me realize I needed to get immersed in the legal world too.

I founded my law firm just a couple years out of law school and have been a trial and business lawyer ever since. Some of the work I love, but I also became disillusioned with the profession in many ways. I decided my quest needed to be making lawyers actually useful to real people—or at least humorous.

LW: What did that realization lead to?

MK: I founded Legal Greenhouse, which is a think tank and experimental playground for various projects to make legal information more accessible to everyone.

Legal Greenhouse Publishing has published two books so far: Why Lawyers Suck: Hacking the Legal System, Part 1, and Green Leaves and Brownies: A Paradoxical Explanation of Cannabis Laws.

LW: What was your intention with publishing these books?

MK: I thought there were other ways I could share my legal expertise beyond one-on-one client work. I wanted to do things that would help educate and change the legal profession. Publishing books that talk about the legal system in a humorous, engaging way is one of those things.

Why Lawyers Suck has some great stories that explain the lawyer mindset to the general public—essentially breaking down why we’re nuts, and how to deal with it as a client.

Green Leaves and Brownies was born from a simple writing prompt I received in a writing group. I sat down with a few people in my group, fleshed the topic out a little more, and realized it would be neat to have as a book. Later that week, I was at Toastmasters. Their speaker had to cancel at the last minute, and they asked if I could give a speech in their place. I decided to present what I’d been writing, and ended up receiving an award for Best Speech of the Night. I thought I was really onto something. From there, I connected with a childhood friend who is also an artist, and she helped pull together the illustrations that really bring the story to life.

LW: How have you serviced the cannabis industry throughout your career?

MK: For about a year, I worked with California Cannabis Lawyers dealing with the business side of the industry. But, I’ll be honest, I got a bit spooked when a local attorney who had a similar practice got slapped with felony charges relating to that representation. I was a single mom, and that kind of risk wasn’t something I was willing to take on at the time.

But although I don’t service the industry directly, I still get clients coming to me for peripheral cannabis issues relating to their day-to-day business practices. “Can my company’s health plan pay for medicinal cannabis for employees? Can a trust pay for a beneficiary’s recreational cannabis? How do I handle employees that I suspect are coming to work high? Can my employer make me take a drug test and then fire me for off-the-clock cannabis use?” These are very real issues that require thoughtful review and legal research.

LW: What about cannabis law interests you?

MK: I love the intellectual challenge. As far as I’m concerned, cannabis law is one of the most complicated areas of the law. For example, in California, there are over 200 different “jurisdictions” governing cannabis growing, processing, sales, and use. From town to town, county to county, there are all different regulations and permissions. There is also the overlap between federal and state laws, and not just what is on the books, but also how various laws are enforced or not enforced. It’s totally fascinating.

LW: What do you find unique about cannabis laws?

MK: Cannabis laws are significantly tethered to politics and social mores—and precious-little reliance on science. The substance we are talking about is a natural product derived from a common plant that grows wild in many places in the US, and it’s not nearly as well understood as it should be. Knee-jerk political reactions ended up with a Class I designation, even though that defies science relating to this substance.

LW: What are some of the challenges of cannabis law?

MK: The overlapping jurisdictions, and just trying to nail down what you can and cannot do with respect to growing, processing, selling, buying, and using. I’ve recently been doing some field research, visiting dispensaries in different states and talking to the proprietors. It has been so fascinating to understand what is working for their businesses and what challenges they have.

Just a few months ago, I was on vacation and visited a local dispensary, looking to share my Green Leaves and Brownies book with them. Within 60 seconds of walking in the door and identifying myself as a lawyer, the owner handed me a letter he’d received from the state department that regulated dispensaries listing some new regulations. He pointed to one sentence in a five-page letter and said “Do you know what this means?”

I took a look at the sentence and realized that, if you interpreted this vague language in one way, his business was toast, but if you interpreted it another way, he was totally in the clear. How do you run a business that way, not knowing from day to day whether your business is legally compliant or not?

This is what people in the cannabis business space are dealing with every day, and I cannot imagine how hard that would be having to constantly worry whether your hard work is going to be taken away by the government without notice.

LW: What’s your favorite thing about cannabis law?

MK: I love that it was fodder for my Green Leaves and Brownie Dr. Seuss parody book. As a trial lawyer, I spend a lot of time giving people bad news, or trying to dig them out of a bad situation. With my book, I’m hoping people can have a good laugh and learn a little about cannabis laws at the same time. And considering how rapid cannabis laws are changing, I’m sure I’ll need to do a follow-up book at some point.

LW: What does the future of cannabis law look like?

MK: Change, change and more change. Lawyers know that the law is an ever-changing landscape in most areas, but that’s so much more the case for cannabis law.

LW: What is some expert advice every cannabis operator should keep in mind when it comes to laws and regulations?

MK: Find a good, experienced cannabis lawyer—or two. Start meeting and collecting contact information for lawyers who handle various aspects of cannabis law, because you may need them at some point. Getting to know lawyers long before you need them is the best way to build trust when you aren’t in some legal distress.

You should also be proactive when it comes to keeping up with impending legal changes that may affect your business. That way, it’s less of a surprise for you later on.

Be very deliberate, and do your due diligence with everyone you do business with. If something goes wrong, your legal remedies aren’t as straightforward as other industries’. Don’t get sucked into business with sketchy people or those with criminal connections either, because that can put an extra target on your back and nobody needs that.

LW: What’s on the horizon for you and Legal Greenhouse? Any upcoming announcements or news?

MK: I am exploring some additional ways to meet the legal and business needs of cannabis businesses, both through BuddingLegal—a curated directory of expert cannabis lawyers—and “Can I Cannabis?” an app for users that allows them instant access to what they can and cannot do in terms of possession, purchase, and use of cannabis where they are, and to connect them with local cannabis businesses.

While I work through the logistics and legal parameters for those projects, I will be continuing in my quest to make lawyers useful—or at least entertaining. In the coming year I expect to publish my second book in my “Hacking the Legal System” series. It will be titled How to Train Your Lawyer, which is somewhat of an operational manual for dealing with lawyers and how to make them a useful part of your business team. For now, you can purchase your copy of Green Leaves and Brownies at https://legalgreenhousepublishing.com (including discounts on bulk orders) as well as Amazon and other online booksellers. [...]

November 14, 2023

Q&A InterviewMelody Kramer’s Green Leaves and Brownies Teaches Cannabis Law à la Dr. SeussThe cannabis industry has been notoriously confusing when it comes to rules and regulations, largely due to the fact that it remains federally illegal. This continued status means cannabis law varies widely from region to region, and operators are required to jump through countless, ever-changing hoops just to remain compliant.

Trial lawyer and writer Melody A. Kramer has familiarized herself with cannabis law enough to know how complicated it can get, and that realization has fueled her latest effort and passion: writing Green Leaves and Brownies: A Paradoxical Explanation of Cannabis Laws, a lighthearted, Dr. Seuss-style book that educates people on the ins and outs of the plant from a court perspective.

Leafwire: How did you first found your law practice?

Melody Kramer: I loved the intellectual exercise of sorting out legal problems. One of my middle school history teachers used to read the class case facts and have us guess the legal outcome. I tended to guess an outcome entirely different than everyone else in the class—however, it was always the right one.

I was also inspired by my uncle, Wilfried Kramer. He wasn’t a lawyer and didn’t even have a college degree, but he worked his way up to be the Clerk for the Third District Court of Appeals in Sacramento. I loved hearing about his cases; it helped me realize I needed to get immersed in the legal world too.

I founded my law firm just a couple years out of law school and have been a trial and business lawyer ever since. Some of the work I love, but I also became disillusioned with the profession in many ways. I decided my quest needed to be making lawyers actually useful to real people—or at least humorous.

LW: What did that realization lead to?

MK: I founded Legal Greenhouse, which is a think tank and experimental playground for various projects to make legal information more accessible to everyone.